Out-of-state property investing

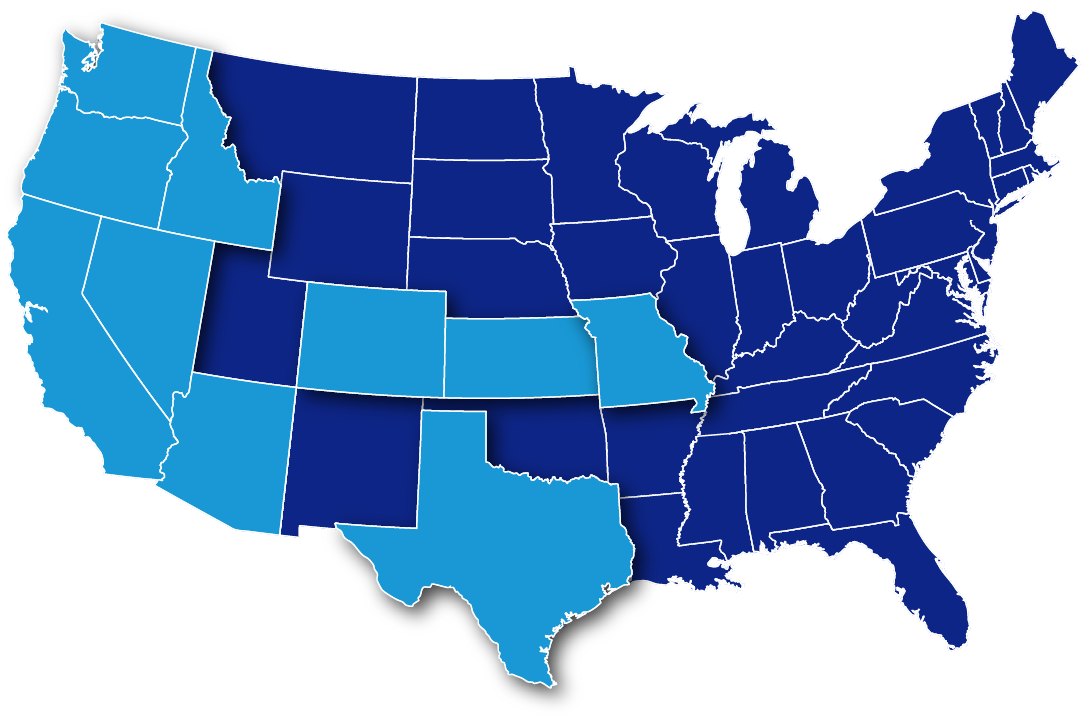

Did you know that o2 Mortgage now lends in 9 states in the Western US and adding more every month? Let us guide you through the opportunities of out of state investing.

Whether buying an investment property or a second home, the right out-of-state investing strategy can prove highly lucrative in the long run. To get the most out of your potential investment, first, consider the following:

Investing out-of-state can be nerve-wracking

You might be buying a property sight unseen. You’ll have to rely on agents and contractors you’ve never met and pay for work you may not inspect.

It takes time

You’ll be establishing a trustworthy out-of-state team. You need to rely on them to get you headed in the right direction. However, you’ll want to do your research and make sure each member can pull their weight.

Managing out-of-state can be more expensive

Unlike a local property, you won’t have the option to self-manage. You’ll need boots on the ground, which come with fees.

Added Freedom

With the above team, you will spend most of your time reviewing reports and paying bills. By not directly managing your properties will increase your bandwidth for other things (including potentially other properties).

Limitless possibilities

Investing out of state allows you to find great investment opportunities regardless of location.

Buying out-of-state allows you to diversify your portfolio

You’ll be able to buy in multiple cities and multiple states. As markets fluctuate or areas impose new restrictions, your entire portfolio will not be affected.

Like anything worth pursuing, you will have to put in the work, but with the right mindset and professional team, out-of-state investing can be a rewarding pursuit.

With the team at o2 now being licensed in multiple states (and personally invested in out-of-state properties), we are ready and able to help you achieve your real estate goals! Call us today to learn more.